Understanding Compound Interest Calculator for Developers

In the finance industry, compound interest is a valuable concept for investors. It is a way of growing your investment over time by earning interest on the principal sum as well as on the accumulated interest. However, computing the compound interest can be a daunting task since it involves a lot of variables such as interest rates, time, and compounded frequency. This is where the compound interest calculator comes into play.

What is a Compound Interest Calculator?

A compound interest calculator is a tool that calculates the interest earned on an investment that earns interest not only on the principal sum but also on any interest earned over time. It is a handy tool for investors since it saves them the hassle of manually computing the returns on their investments. The calculator provides an estimate of the future value of an investment, the interest generated, and the total amount at the end of the investment period.

Developers can also integrate compound interest calculators into their applications to help their users calculate interest on loans or savings account balances.

How Does a Compound Interest Calculator Work?

The compound interest formula is used in the calculator to calculate interest. The formula is:

A = P (1 + r/n) ^ (nt)where:

- A = the future value of the investment

- P = the principal amount

- r = the annual interest rate (as a decimal)

- n = the number of times the interest is compounded per year

- t = the number of years the money is invested

By inputting these variables into the calculator, it can provide an accurate estimate of the investor’s earnings.

Sample Code or Commands

You can easily create a compound interest calculator using various programming languages such as Java, Python, or JavaScript. Here is an example of a simple compound interest calculator in Java:

import java.util.Scanner;

public class CompoundInterestCalculator {

public static void main(String[] args) {

Scanner scanner = new Scanner(System.in);

System.out.print("Enter principal: ");

double principal = scanner.nextDouble();

System.out.print("Enter interest rate: ");

double interestRate = scanner.nextDouble();

System.out.print("Enter number of years: ");

int numberOfYears = scanner.nextInt();

System.out.print("Enter compounded frequency: ");

int compoundedFrequency = scanner.nextInt();

double futureValue = calculateFutureValue(principal, interestRate, numberOfYears, compoundedFrequency);

System.out.printf("Future value: $%.2f", futureValue);

}

public static double calculateFutureValue(double principal, double interestRate, int numberOfYears, int compoundedFrequency) {

double ratePerPeriod = interestRate / compoundedFrequency;

int periods = numberOfYears * compoundedFrequency;

double futureValue = principal * Math.pow(1 + ratePerPeriod, periods);

return futureValue;

}

}Scenarios of Using Compound Interest Calculator for Developers

As a developer, you can use compound interest calculators in various applications. For example:

- Banks and financial institutions can use the calculator to calculate the interest on loans, mortgages, and other financial products.

- Investment firms can use the calculator to estimate the returns on various investment options.

- Personal finance apps can use the calculator to help users budget and plan their investments.

Key Features of Compound Interest Calculator

Below are some key features of a compound interest calculator:

| Features | Description |

|---|---|

| Principal | The initial amount invested |

| Interest Rate | The rate of interest earned on the investment |

| Time | The investment period in years |

| Compounded Frequency | The number of times the interest is compounded in a year |

| Future Value | The estimated value of the investment at the end of the investment period |

Misconceptions and FAQs

Misconception: Compound interest always works in your favor

Reality: While compound interest can work in your favor, it can also work against you. For example, if you have a high-interest loan, the compounded interest can quickly accumulate, and you may end up paying more than you borrowed.

FAQ: How often should interest be compounded to maximize returns?

Answer: The frequency of compounding interest depends on the investment product. Generally, the more frequent the compounding, the higher the returns. However, it is always advisable to consult a financial advisor before making investment decisions.

FAQ: Can interest rates be negative?

Answer: Yes, interest rates can be negative, which means that instead of earning interest, you will pay interest to keep your money in a bank account.

Conclusion

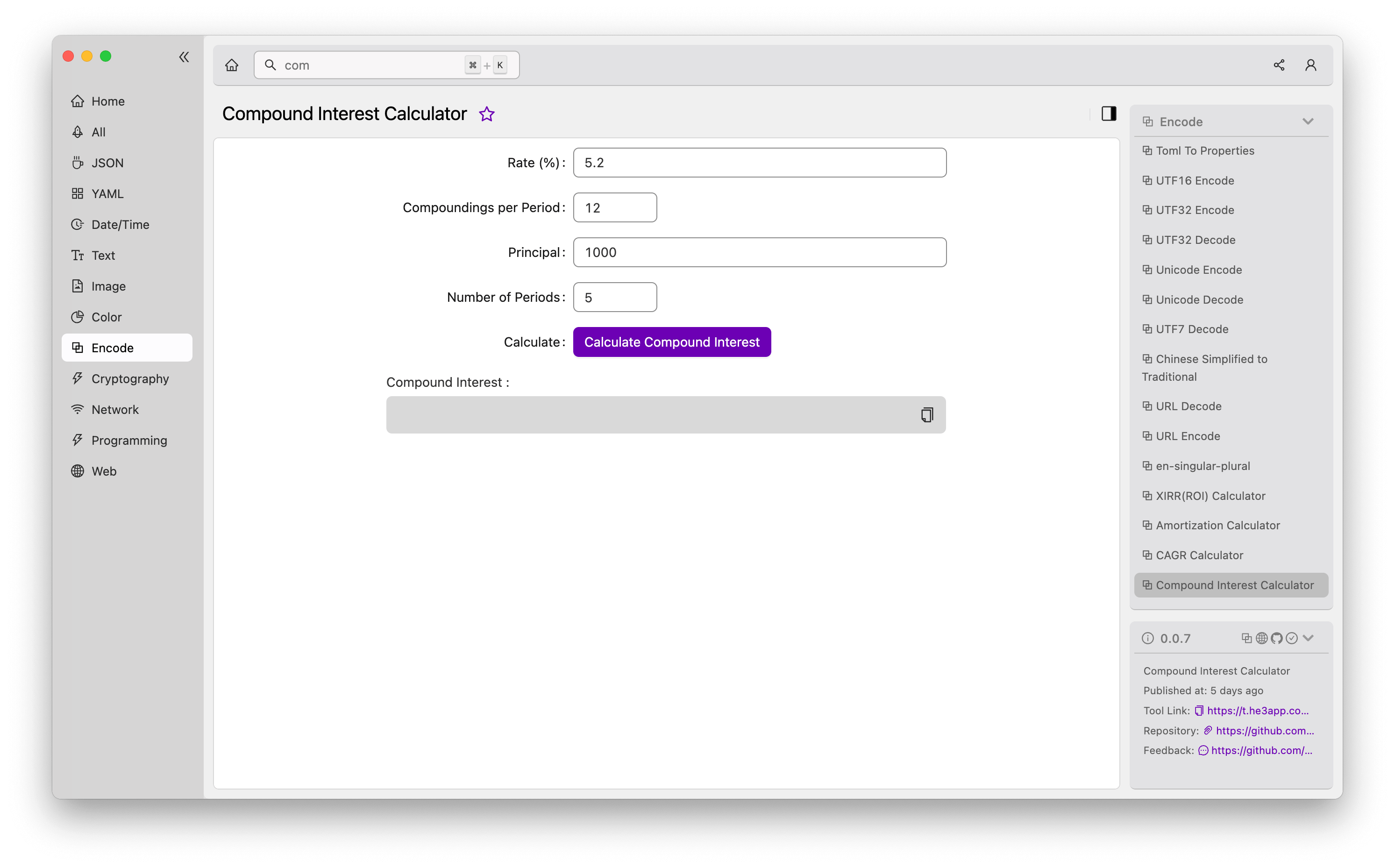

A compound interest calculator is an essential tool for investors and developers. It simplifies the process of computing interest and helps investors make informed investment decisions. Developers can integrate compound interest calculators into their applications to help users calculate interest on loans or savings accounts. Or you can use Compound Interest Calculator tool in He3 Toolbox (https://t.he3app.com?y6m7) easily.

For more information on compound interest calculators, you can refer to the Wikipedia page.